How to Calculate Direct Labor Rate Variance

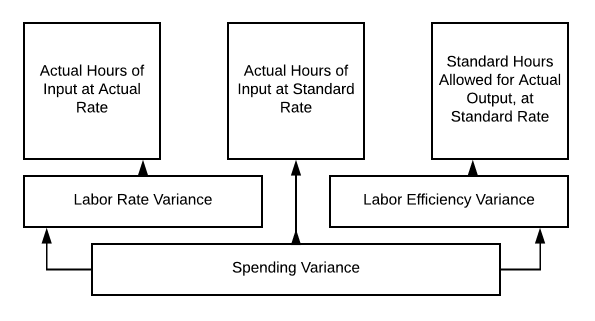

To calculate the number multiply the direct labor hourly rate by the number of direct labor hours required to complete one unit. LRV Standard Rate less Actual Rate Actual no.

Labor Rate Variance Accounting For Managers

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

. It is the actual hourly rate paid to labor. An adverse labor rate variance indicates higher labor costs incurred during a period compared with the standard. To understand the computation of this variance see the following formula.

We identified it from well-behaved source. Calculating the Direct Labor Rate Variance and the Direct Labor Efficiency Variance Guillermos Oil and Lube Company is a service company that offers oil changes and lubrication for automobiles and light trucks On Dullermo has found that the takes 24 minutes and 62 quarts of all are used. This variance is also known as direct labor price variance.

Increase in the national minimum wage rate. Calculate the total direct labor variance for oil changes for June. What if the actual wage rate paid in June was 1500.

It is a very important tool for management as it provides the management a very close look at the efficiency of labor work. Total cost of direct labor 53460. Calculation for actual.

As with direct materials variances all positive variances are unfavorable and all negative variances are favorable. Standard rate per hour. Inputs to be provided.

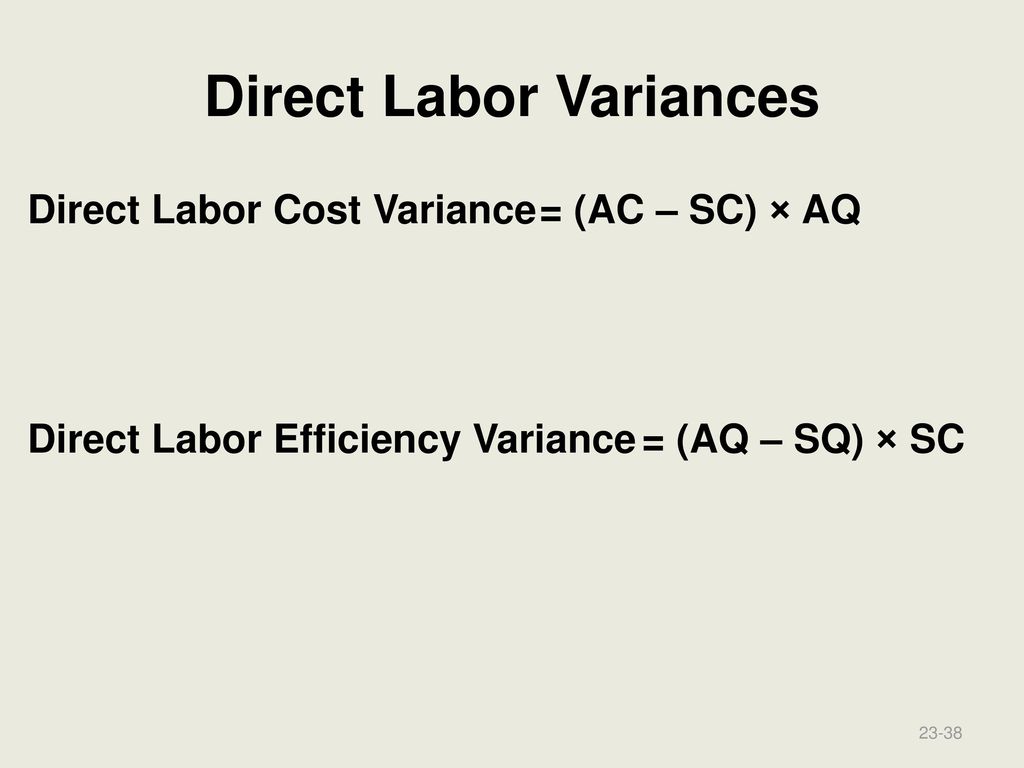

In June Guillermos Oil and Lube had 070 oil changes. Actual rate per hour. Which of the following equations is used to calculate direct labor rate variance.

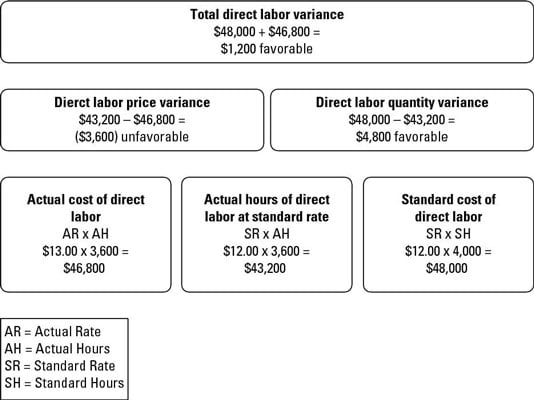

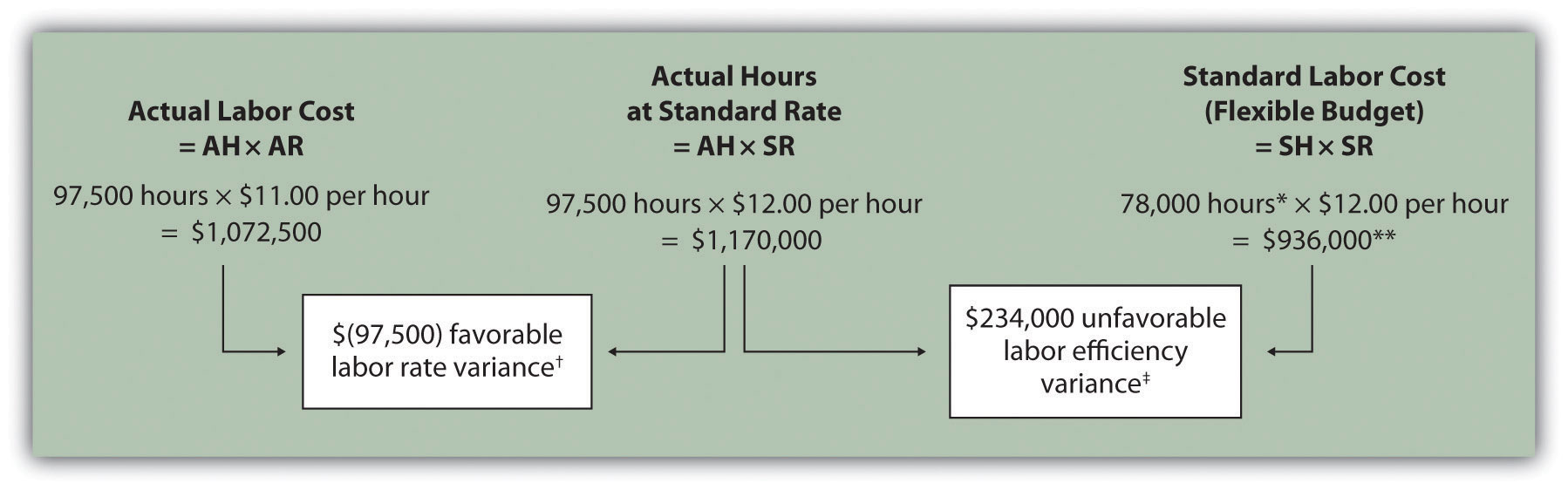

To compute the direct labor price variance subtract the actual hours of direct labor at standard rate 43200 from the actual cost of direct labor 46800 to get a 3600 unfavorable variance. Calculate the direct labor rate variance LRV and the direct labor efficiency variance LEV for June using the formula approach. Company A makes mobile and it knows that it needs 2 labor hours at 2 per hour to produce one unit of mobile.

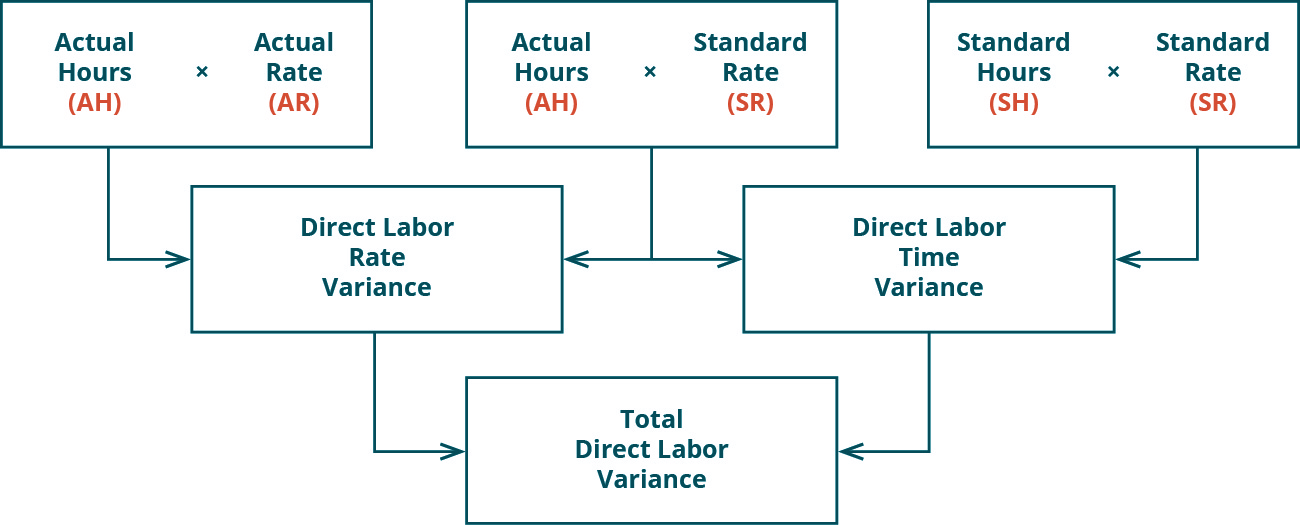

Direct labor rate variance Actual rate per hour - Standard rate per hour Standard hours b. Causes for adverse labor rate variance may include. The actual direct labor rate is 38.

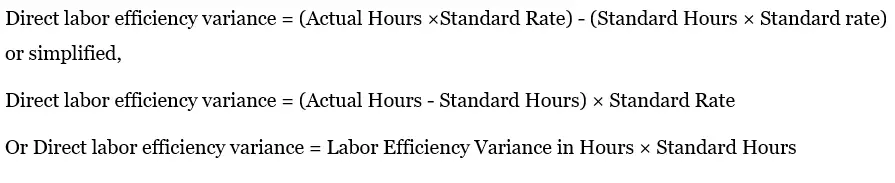

Direct labor rate variance Actual rate per hour - Standard rate per hour Actual hours d. For example assume your small business budgets 410 labor hours for a month and that your employees work 400 actual labor hours. Labor efficiency variance equals the number of direct labor hours you budget for a period minus the actual hours your employees worked times the standard hourly labor rate.

Direct labor efficiency variance Actual labor hours budgeted labor hours Labor efficiency variance compares the actual direct labor and estimated direct labor for units produced during the period. Note that both approachesdirect labor rate variance calculation and the alternative calculationyield the same result. To determine labor cost as a percentage of operating costs simply replace gross sales with total costs in the equation.

How to used direct labor rate variance calculator. To compute the total direct labor variance use the following formula. We assume this kind of Direct Labor Cost Variance graphic could possibly be the most trending topic as soon as we allocation it in google improvement or facebook.

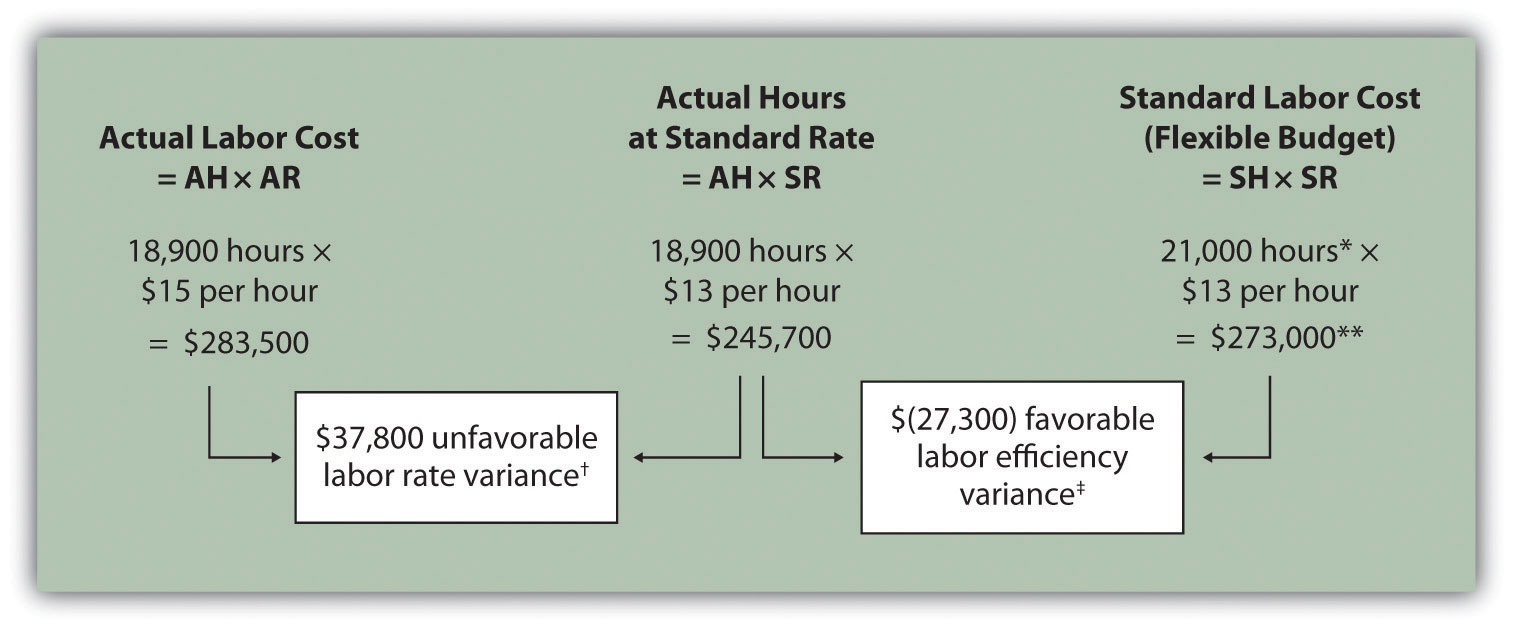

Calculate the variance. 4000 Standard direct labor rate 30000 - 29000 4000 Standard direct labor rate 1000 Standard direct labor rate 4 b. Labor rate variance ARSRAH 151318900 37800 unfavorable.

Direct labor rate variance LRV Direct labor efficiency variance LEV 2. How to Calculate Direct Labor Cost per Unit. Calculate the direct labor hours.

Direct labor hours used 4950 hours. Direct labor rate variance Actual rate per hour Standard rate per hour Actual hours c. Inappropriately high setting of the standard cost of direct labor which may in the hindsight be attributed to inaccurate planning.

Number of good units produced 9000 units. Hitech manufacturing company is highly labor intensive and uses standard costing system. An unfavorable variance means that the cost of labor was more expensive than anticipated while a favorable variance indicates.

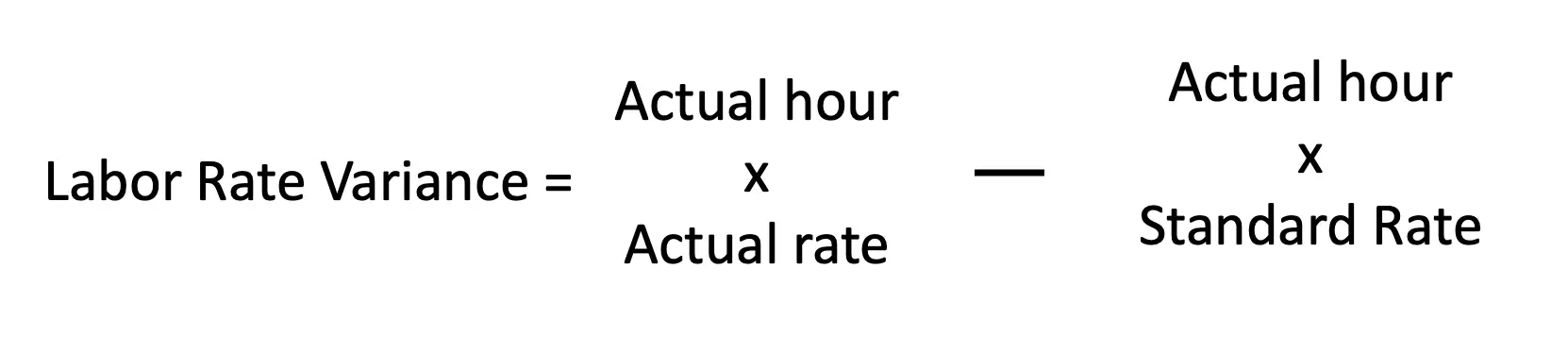

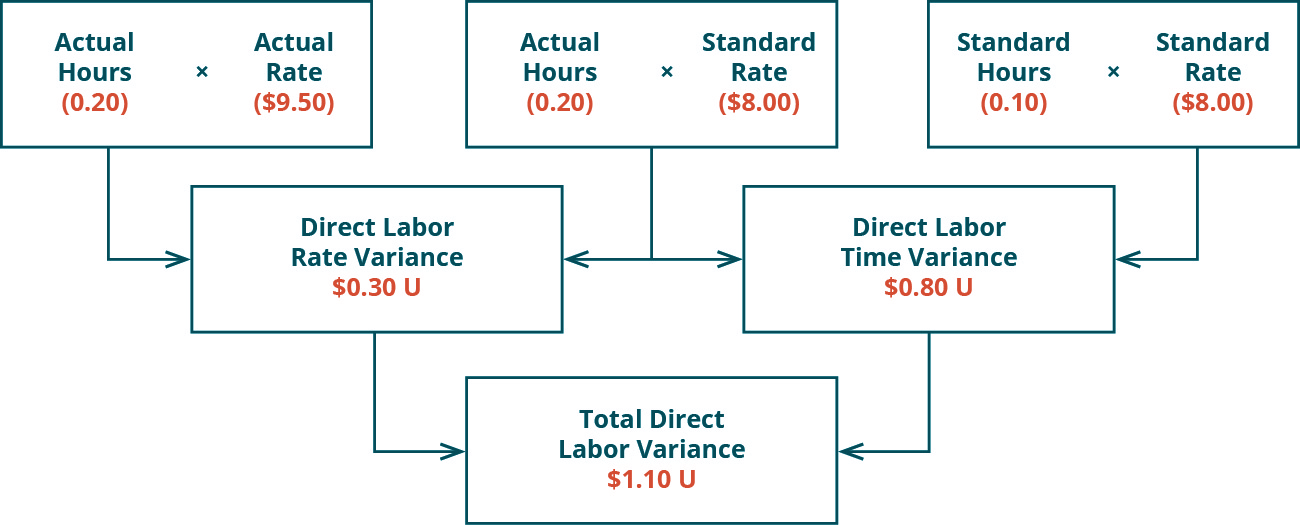

Total direct labor variance SR x SH AR x AH 1200 x 4000 1300 x 3600 48000 46800 1200 favorable According to the total direct labor variance direct labor costs were 1200 lower than expected a favorable variance. Actual rate - Standard rate x Actual hours worked Labor rate variance. For example if the direct labor hourly rate is 10 and it takes five hours to complete one unit the direct labor cost per unit is 10 multiplied by five hours or 50.

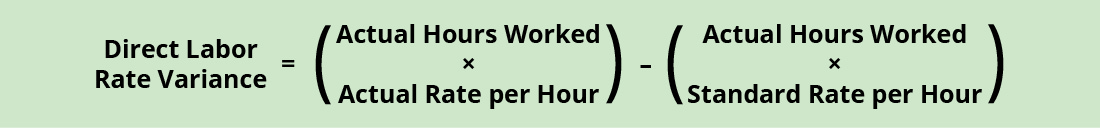

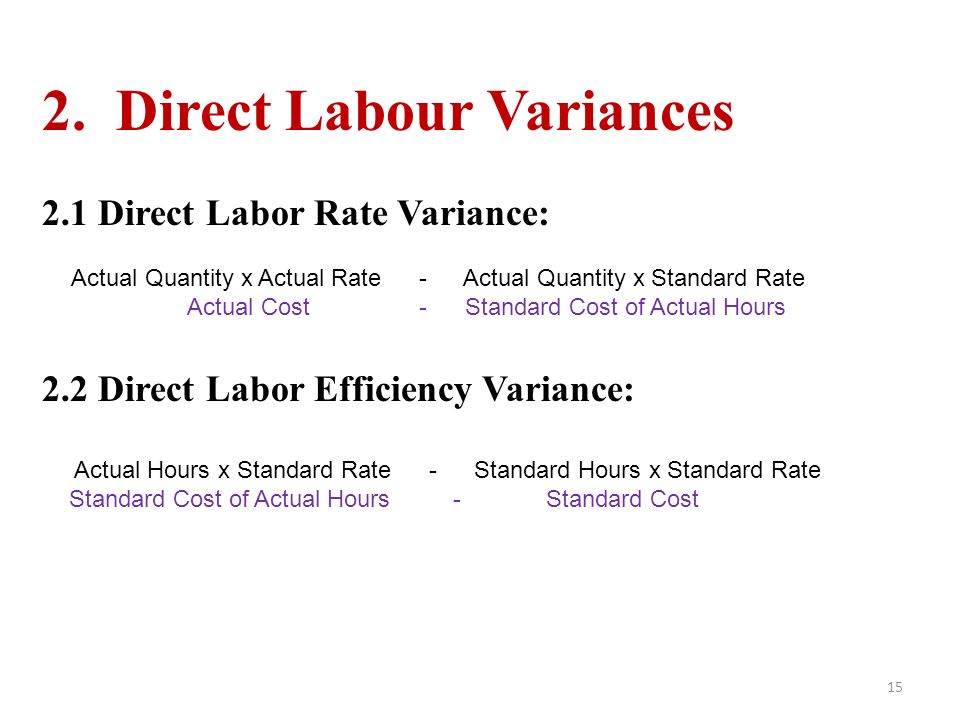

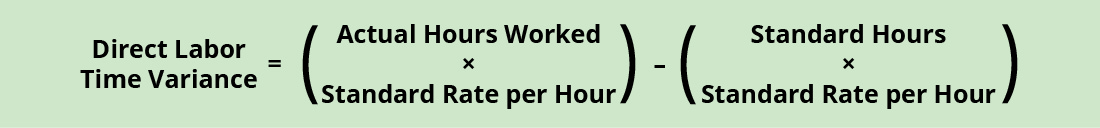

It is the hourly rate determined at the time of setting standards. It is calculated as the difference between the actual labor rate paid and the standard rate multiplied by the number of actual hours worked. Using the labor time standard of 05 labor hour per unit and a labor cost standard of 10 per labor hour for a 10 pound bag of chocolate and the following actual cost and usage data compute the direct labor rate variance.

Direct labor rate variance Actual hours worked Actual rate Actual hours worked Standard rate Example. Calculate the labor cost per unit. First calculate the direct labor hourly rate that factors in the fringe benefits hourly pay rate and.

Calculate the direct labor hourly rate The hourly rate is obtained by dividing the value of fringe benefits and payroll taxes by the number of hours worked in the specific payroll period. Employing diagrams to work out direct labor. We can use the following formula to calculate the labor rate variance.

Lets consider a simple example to understand the calculation of LRV. Calculate the direct labor hourly rate. This result means the company incurs an additional 3600 in expense by paying its employees an average of 13 per hour rather than 12.

Here are a number of highest rated Direct Labor Cost Variance pictures upon internet. Its submitted by giving out in the best field.

Direct Labor Efficiency Variance Managerial Accounting Youtube

Flexible Budgets And Standard Cost Systems Ppt Download

How To Calculate Direct Labor Variances Dummies

Compute And Evaluate Labor Variances Principles Of Accounting Volume 2 Managerial Accounting

Direct Labor Variance Analysis Accounting For Managers

Labor Rate Variance Definition Formula Video Lesson Transcript Study Com

Direct Costs In Standard Costing Online Accounting Tutorial Simplestudies Com

Compute And Evaluate Labor Variances Principles Of Accounting Volume 2 Managerial Accounting

Direct Labor Variances Example Youtube

Direct Labour Cost Variance Dlcv Study Material Lecturing Notes Assignment Reference Wiki Description Explanation Brief Detail

Afm Standard Costing Variance Analysis Isuru Nadeesha Manawadu Ppt Video Online Download

Labor Rate Variance Example Cause Solution Accountinguide

Direct Labor Efficiency Variance Double Entry Bookkeeping

Compute And Evaluate Labor Variances Principles Of Accounting Volume 2 Managerial Accounting

Variable Overhead Efficiency Variance Formula

Compute And Evaluate Labor Variances Principles Of Accounting Volume 2 Managerial Accounting

Direct Labor Variance Analysis Accounting For Managers

Comments

Post a Comment